Written By: Magnus Almqvist

|

In the fast-paced world of capital markets, choosing the right software vendor is crucial for optimizing trading operations and staying competitive

Technology ina

In early December, Microsoft announced it would be buying a 4% stake worth £1.5bn in London Stock Exchange Group (LSEG) to provide the exchange with data analytics and cloud infrastructure products. This follows on from announcements the previous year that Google would invest $1bn in CME Group and move the futures exchange operator’s trading systems to the cloud, and that Nasdaq and Amazon Web Services were partnering to build the next generation of cloud-enabled infrastructure for the world’s capital markets. One analyst described the situation to the FT as an “arms race” between Microsoft, Amazon, and Google to win deals with the race to cloud having been accelerated through and post-Covid.

This bout of activity begs the question as to what types of technological changes will likely affect market infrastructures and—more specifically—where will these big tie-ups leave the smaller, more traditional exchanges?

novation has enabled the growth of digital asset classes. The tokenization of traditional and crypto trading was just the beginning. Everything is tradeable and tokenized now: Carbon credits, real estate, art, wine, music, collectibles, e-sports, influencers, and more.

Even after the regulatory freeze on crypto securities, especially in 2022, we are still experiencing more financial institutions tokenizing bonds, as well as regulated entities distributing stock tokens or using the blockchain for pre-IPO liquidity.

Not to be mistaken with cryptocurrency assets, digital assets (or tokens) can represent a variety of ‘things’ such as ownership in a company, access to a particular service, or even a physical asset such as gold. The main difference between these two types of assets is their primary use case. Cryptocurrencies are mainly used as a means of exchange, whereas digital assets or tokens can represent a wide variety of things beyond just currency. Additionally, cryptocurrencies are often decentralized, while digital assets or tokens can be decentralized or centralized depending on the specific blockchain network they are built on.

HSBC predicted that digital assets could reach 24 trillion USD by 2027, up from $2T in 2021, according to Finoa. JP Morgan has a plan to tokenize trillions of dollars of assets to develop new mechanisms in financial services such as trading, borrowing, and lending.

Equity, funds, debt, and real estate can all benefit from tokenization. Mid-cap companies, investment banks, asset managers, funds, and stock exchanges from around the globe are already starting to shift towards blockchain-based financial assets.

“I believe the next generation for markets, the next generation for securities, will be tokenization of securities,” BlackRock’s Larry Fink, who’s previously expressed skepticism over crypto, told New York Times.

When considering software solutions, market operators can work with an independent software vendor (ISV). In this article, we will explore the pros and cons of partnering with an ISV in the capital markets industry, and why Exberry provides all the advantages, and none of the disadvantages, of partnering with an ISV.

Advancement of Key Technologies

The fact that the operation of global markets appears to be on the precipice of change is due to the particular advancement of a few key technologies. Firstly, the development of cloud computing has dramatically decreased cost of ownership and increased the ability to access advanced computing power – once the domain of only a handful of Tier 1 banks. Easily scalable and elastic to business requirements, cloud-native (or even better, cloud-agnostic) organizations have access to a wide array of service technology options without the need for costly upgrades of large infrastructure projects.

Secondly, the closely-related concept of Software-as-a-Service (SaaS) can reduce operational costs while helping focus organizational resources upon business functions, and operating systems for business purposes rather than underlying tech. In a SaaS arrangement, cloud management is performed by those with a detailed understanding of system monitoring, continuous optimization of resources, and elastic operations (all with immediate access to 3rd line support). Regular upgrades mean that security settings and patches are kept up to date at all times, negating the need for cumbersome software updates.

Thirdly, as an evolution of the technology used by today’s crypto markets, there is now the ability to create (or tokenize), transfer, and store financial instruments on the blockchain. This is expected to speed up asset creation and definition, open up initial placement markets, and eliminate the need for reconciliation processes. Due to the realization of faster settlement cycles in secondary markets, market risk can be reduced in a boost to market efficiency. In commodity markets, for example, a much closer tie-up between settlement cycle and delivery process of the actual commodity can occur.

Survival of the Fittest

The evolution of these key technologies mentioned above is reminiscent of comments made by former Barclay CEO, Anthony Jenkins, five years ago on the future of banks:

“Now we will see the possibility, not necessarily the probability of what we call a ‘Kodak moment,’ where increasingly banks become irrelevant to their customers. This is just in the footprints of what’s going to happen here. As these technologies season and develop, we can imagine total transformation of the banking system, using Blockchain for example, in a world where banks don’t really exist anymore.”

It seems the conundrum of banks has caught up to stock exchange operators, with LSEG, CME, and Nasdaq leading the charge to modernize. Yet with the prospect of a technological arms race amongst trading facilities on the horizon, how can smaller, more regional exchange operators be expected to fare?

Cloud-Based Matching & Trading Engine Technology – as SaaS

In an effort to modernize, smaller exchange operators likewise need integrated cloud-native solutions, provided as a SaaS application and based on enterprise-grade technology. Matching and price discovery capabilities need to be available to trade any asset, whether that is deliverable commodities via exchange-traded products and digital securities, or a brand-new asset that has yet to be realized.

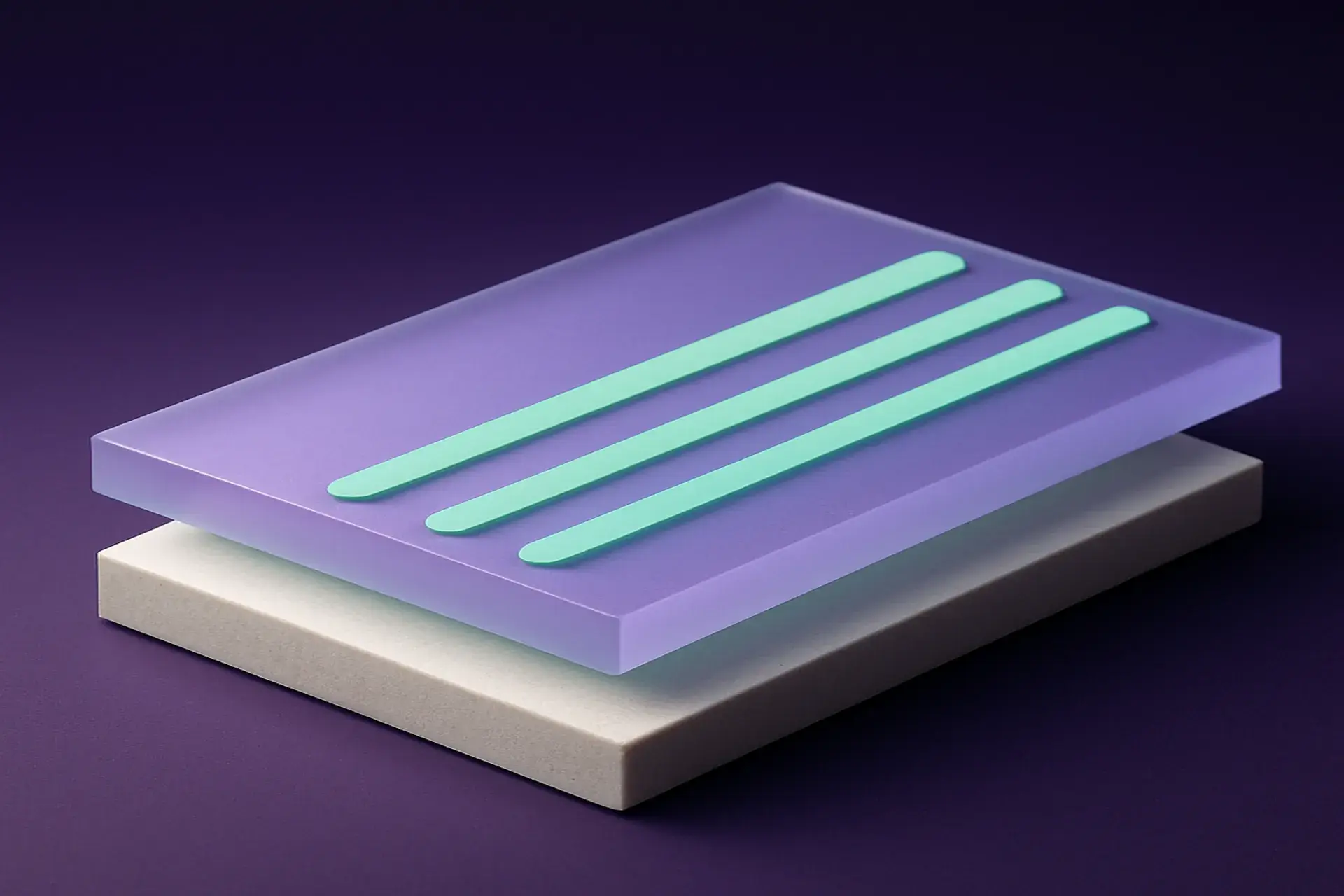

In recent years, Matching & Trading Engine technologies have been developed as out-of-the-box solutions. Exchanges can now, therefore, focus on building proprietary domain-specific modules, ecosystems, and communities around an array of assets, while using all trading core functionalities “as a service”. These integrated solutions are distributed ledger-agnostic, meaning they can support both a tokenized security as well as traditional ecosystems, and can centrally clear markets of any type in a fraction of the time and cost, eliminating any need for reconciliation. The technology can also fully automate the intra and top-day margin process, enable pre-trade and pre-order risk and collateral calculations, and maintain an immutable audit trail of orders and trades.

The benefits of these accessible solutions are that they are cloud agnostic, and cloud access is managed via a relationship with the vendor rather than an exchange itself. This means operators can avoid direct competition with dominant exchanges when they access a cloud run by AWS, Google, or Microsoft for example. Through a SaaS-based trading platform, multiple sites can be run on opposite sides of the world and, depending on latency requirements, systems can be run on a hot-hot deployment, meaning that both servers can accept client connections at the same time. Further, the hassle of managing the cloud is removed as it is the vendor who is responsible for interfacing and building relationships with the cloud provider.

Staying Power

One thing is clear, in order to stay relevant, exchange operators, large or small, need to develop their business strategies – and technology is a crucial enabler of this. Choosing those technologies that will provide the best impact on business is important, but even more paramount is choosing the right vendor and partner to ensure their successful delivery, launch, and ongoing operations. To sidestep the dreaded ‘Kodak moment’ that has haunted firms not willing to adapt, the successful implementation of innovation is crucial to surviving the current race to the cloud, as well as future prospects of business growth and evolution.

Innovation Spotlight: Abaxx and the Future of Multi-Market Flexibility

Abaxx’s launch of co-located spot and futures infrastructure in Singapore represents a new approach to handling physical and financial trading of gold.

Always On: Building Infrastructure for 24×7 Exchange Operations

Continuous trading has moved from concept to operational reality. Global market participants increasingly expect round-the-clock access for price discovery, liquidity management and risk mitigation.

Market Matters: Building Markets for Tomorrow’s Asset Classes

Global market infrastructure is entering a new era shaped by rapid digital adoption and shifting participant expectations. Operators capable of supporting any asset, in any environment, will lead the next phase of market evolution.